Our Year — 2023

President and CEO Anthony A. Joyce, III, led the Chelsea Groton team through a year of building in 2023. The Bank’s headquarters was re-built to serve our team, customers, and the community. Our Chelsea Groton Foundation continued to build its impact on local organizations, surpassing $6 Million in giving since its founding 25 years ago. Our team built new relationships and grew existing ones with customers and community partners. Our commercial lending portfolio grew to record levels, and so did our commitment to supporting individuals and businesses as they reached their goals in a safe, secure, and financially sound way. And we built financial wellness knowledge in workplaces, at schools, in branches, and at community centers throughout the region.

Chelsea Groton was honored to receive the following awards and recognition:

Forbes:

Best in State Banks

(2021 – 2023)

BauerFinancial:

Best of Bauer Bank

(1994 – 2023)

The Day:

Best Bank

(2015 – 2023)

Hartford Courant:

CT Top Workplace

(2016 –2023)

Commercial Record:

Fast 50 &

CT Top lenders

Team

“Our regional managers have really worked with me and made sure that we’re learning as much as we can. I’ve seen not only myself grow, but I’ve had a team member in my branch get promoted since I’ve been here… There have been so many opportunities I’ve been afforded here that have really helped me in my growth.” – Ed Cotto-Morales, Customer Solutions Manager in Norwich

Chelsea Groton was named a “Top Workplace in CT” by The Hartford Courant for the 8th consecutive year. President and CEO Anthony A. Joyce, III was also honored with the Top Workplace Leadership Award.

Whether new to the Bank or a long-tenured Chelsea Groton employee, team members at all levels participated in over 100 in-person professional development courses this year, with 20 courses specifically focused on leadership. Over 6,500 Blue Ocean Brain bite-sized learning courses were completed throughout the year. And several team members pursued their quest for knowledge by completing 47 college-level courses offered through the Center for Financial Training.

Team Chelsea proudly volunteered nearly 7,000 hours of their own time to help organizations who do incredible work for the people and causes of our local community. Many members of the team serve on boards, help at schools, churches, libraries, and food pantries, and volunteer for youth sports, community events, and more. The Bank’s strategic planning leadership team traded in a meeting session to spend a morning volunteering with FRESH New London. Throughout the year, team members supported food and supply drives, raised funds for 21 worthy causes through Casual for a Cause days, contributed to the United Way capital giving campaign, participated in activities for developing physical and mental wellbeing, and enjoyed employee appreciation days.

5,268 online training

courses completed

6,898 employee

volunteer hours

$7,000 RAISED THROUGH

Casual for a cause days

Community

“When we help a family, we help them at their weakest moments… We could not do that without support from places like Chelsea Groton Bank and Chelsea Groton Foundation… In a time of need we know we can reach out to Chelsea Groton and we know they will be there for us.” – Tricia Cunningham, Executive Director, Always Home

During the Chelsea Groton Foundation’s 25th anniversary year, over $605,000 in grants, Acts of Kindness donations, scholarships and other donations were distributed. Since its founding, the Foundation has awarded $6.2 million to non-profit organizations in the community that support programs related to Arts and Culture, Economic Development, Education, Environment, Health and Human Services, Housing, and Youth Activities.

In addition, the Bank provided $150,241 in sponsorships to 130 local non-profits. In lieu of holiday gifts, Chelsea Groton adopted 50 members of the community during the holiday season.

The Bank’s Chelsea University financial wellness program educated over 2,200 attendees on 71 unique topics, including budgeting, credit, scam awareness and identity theft protection, buying a home, using an iPhone, STEAM classes for kids, business marketing and cash flow management, retirement planning, and more. Branches also hosted pet adoption days, craft events, book signings, and shred days, amongst other complimentary programming for community members to enjoy.

230 financial wellness programs offered to community members

142 organizations selected by team members to receive $22,700 in Acts of Kindness donations

$6.2 million in giving since

Foundation was founded

Personal

“When I go to Chelsea Groton Bank, they always greet me by my name. They’re always very friendly. And they’re always able to figure out my problems and give advice. I would definitely tell people if they’re not happy at their bank, try Chelsea Groton…you won’t be disappointed.” – Mark, customer since 2023

“Gone are the days of that formal setting… We have that space now to sit next to a customer… and really dive into what they’re looking to do and offer all sorts of solutions for them.” – Regan Nichols, Customer Solutions Manager, Groton

In addition to the Groton branch remodel that occurred on the ground floor of the newly renovated headquarters building, the Bank also invested in reinventing the New London, North Stonington, and Waterford branches in 2023. Customers and team members alike have benefited from the collaborative environment and comfortable spaces to have conversations, attend financial wellness classes, and participate in enrichment activities.

Customers also have access to personalized experiences from anywhere through new digital offerings that were launched in 2023. The Manage My Money and Credit Score tools, available through the Bank’s mobile app, use a customer’s personal financial information to assist in building budgets, monitoring credit and establishing credit goals, and financial planning. The Chelsea Calendar tool can be accessed from the website for phone, virtual, and in-person appointments for personal and business products and services.

4 branches

reinvented

95.84%

Customer Satisfaction*

4 in-branch

Career Fairs

*Overall Performance Score in Customer Satisfaction Surveys

Homeownership

“I was working with a couple who had rented their home for many years and had the opportunity to purchase it. One spouse had the primary income, but poor credit, and the other spouse had good credit, but only worked part time. I suggested that if they could find a cosigner, an FHA loan could be possible. We worked with the buyers, along with attorneys, to take them from application through close. I was so pleased we were able to find a solution that worked for all parties, and most importantly kept the buyers in their home, and a community, they loved.” – John Cassata, Mortgage Specialist, Chelsea Groton Bank

2023 marks another consecutive year of Chelsea Groton providing more loans in New London County than any other bank.*

While inventory continued to be low, the Chelsea Groton team helped over 100 borrowers to purchase their first home. And, the Bank provided nearly $2 million in loans, grants and downpayment assistance to over 30 individuals and families by partnering with a variety of state, federal, and private partnership programs designed to help resolve housing needs.

Chelsea Groton continues to participate in Lawrence + Memorial Hospital’s HOME program, which provides eligible L+M employees with partial loan forgiveness, home buying support, and educational opportunities, when they purchase a home in the city of New London.

The Bank provided credit and homebuying education throughout the region, including a new homebuyer dual-language class taught in English and Spanish. Chelsea Groton also sponsored a seminar for realtors to help them maintain required continuing education credits.

assisted 105

First-time

homebuyers

$1.9 million in loans,

grants, and downpayment assistance provided

closed 671

consumer and

mortgage loans

286 home equity

loans and lines

of credit

*The Warren Group, Inc. Mortgage Marketshare Module Report- All Residentials, All Regions in New London County, CT Annual 2023

Business & commercial

“Chelsea Groton is not just Fairview’s bank. They’re a partner… Chelsea Groton is different because of relationships. They sit at the table. They hear your dreams, they hear your visions. And they want to be part of that. They never say, ‘we can’t’. They say, ‘how can we?’.” – Liisa Livingston, CFO, Fairview

The commercial lending team worked tirelessly to support the business community and growth of our local economy, generating $142 million in new commercial loans in 2023. Over $38 million of those new loans was for working capital, equipment financing, or expansion of nearly 60 small businesses in the local area. And the Bank provided $59 million in construction financing to support a wide range of projects, including medical, industrial, storage, residential, mixed use, and a sports facility.

Cash management service deployments, including tools to help businesses speed up payment and collection timeframes, and safeguard accounts through unprecedented check and ACH fraud, increased by 63% year-over-year.

While providing digital tools for businesses to manage their accounts safely and efficiently, Chelsea Groton’s approach to provide in-person support and commitment to be a banking partner has never wavered. The cash management team continued to cultivate business, non-profit and municipality account relationships, with a focus on hands-on product implementation and training.

Together with the Bank’s Community Education Officer, a series of classes through the Financial Wellness at Work financial literacy program were provided to four area employers. And business customers were also educated about fraud and cyber threats during a cyber security panel discussion, and the many tools available to help safeguard their accounts through programs throughout the year.

$142 million in

new commercial loans

$30 million in

new business deposits

20+ EDUCATIONAL programs for the business community

Investments (CGFS)

“Our commitment to provide world class service to each individual investor remains our top priority, as it has always been. We’re proud to offer more resources and financial planning tools to our clients through Osaic Institutions, while still providing the high level of personalized service clients have always experienced with our team.” – Jennifer Eastbourne, VP, Chelsea Groton Financial Services; Program Coordinator, Osaic Institutions, Inc.

Chelsea Groton’s Financial Services team focused on proactively educating clients and prospects through one-on-one conversations and by offering retirement planning and social security seminars.

When the team meets with clients, they use the Riskalyze/Nitrogen tool to measure clients’ risk tolerance and, along with the financial advisor’s many years of experience, knowledge, and additional resources, the advisor makes recommendations for investment vehicles that match a client’s desired outcomes.

CGFS also introduced AssetMap, a financial planning tool that visually organizes all of a household’s finances in graphic and allows clients to view their entire financial picture, including gaps.

Chelsea Groton Financial Services’ broker-dealer was rebranded from Infinex Investments to Osaic Institutions in the fall. With this change, clients benefit from the additional financial planning and technology resources available through the larger broker-dealer, but the direct access, relationships, and personalized service clients have come to expect from CGFS will remain unchanged.

150+ years of combined

financial advisory experience

Investment and insurance products and services are offered through Osaic Institutions, Inc., Member FINRA / SIPC. Chelsea Groton Financial Services is a trade name of Chelsea Groton Bank. Osaic Institutions and Chelsea Groton Bank are not affiliated. Products and services made available through Osaic Institutions are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank or bank affiliate. These products are subject to investment risk, including the possible loss of value.

Check the background of this Osaic Institutions, Inc. investment professional at brokercheck.finra.org/

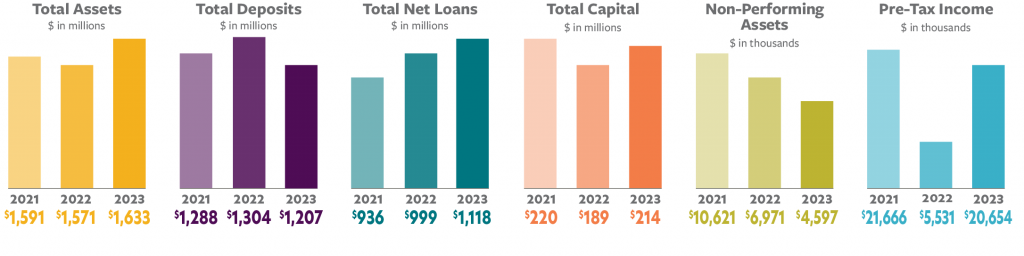

Financials

| For the Years Ended Dec. 31, 2023 and 2022 | 2023 | 2022 | ||

| Total interest and Dividend Income | $55,587,418 | $45,353,526 | ||

| Total Interest Expense | $7,826,032 | $1,694,110 | ||

| Provision for Loan Losses | $900,000 | $450,000 | ||

| Net Interest Income After Provision for Loan Losses | $46,861,386 | $43,209,416 | ||

| Total Noninterest Income | $9,510,271 | $8,821,307 | ||

| Total Noninterest Expense | $38,940,930 | $35,488,160 | ||

| Net Operating Income | $17,430,727 | $16,542,563 | ||

| Realized Security Gains/(losses) | $470,597 | ($2,717,988) | ||

| Unrealized Security Gains/(losses) | $2,752,943 | ($8,293,537) | ||

| Income Tax Expense | $3,887,395 | $607,867 | ||

| Net Income | $16,766,872 | $4,923,172 |

Loan Mix: Residential Mortgage 74% | Commercial Mortgage 21% | Commercial 4% | Consumer 1%

Team Member Graduations, Honors, and Awards

2023 Launch Management Training graduates – Samantha Bazydlo, Alyssa Bryan, Edwin Cotto-Morales, Alicia Hudak, Teri LaBranche, Amanda Morin, Deborah O’Brien

Chamber of Commerce of Eastern Connecticut Leadership Program 2023 graduates – Krissa Beene, Marielle Winkelman

Connecticut School of Finance and Management 2023 graduates – Alexis Kahn, Kristin Zummo

ASPIRE 2023 graduates – Yana Kozleva, Rebecca Wesolowski

New England Leadership Development Program 2023 graduates – Tamela Higgins, Sara Lundy, Marielle Winkelman

Greater Norwich Area Chamber of Commerce LEAD Program 2023 graduates – Mandy Crispim, Jennifer Willingham

Connecticut Bankers Association ‘New Leaders in Banking’ – Jennifer DeLucia, Bill Mundell

Greater Norwich Area Chamber of Commerce ‘Chamber Service Award’ – Miria Gray

Top Workplace Leadership Award – Anthony A. Joyce, III

George W. Strouse ‘Spirit’ Award winners – Harry Colonis, Sara Lundy

Chelsea Award winners – Vira Fiore-Labreque, Mira Gray, Andy Irizarry

Officer promotions

Jessica Todd, Executive Vice President

Alex Masse, Executive Vice President

Larry Walker, Senior Vice President

Mario Siciliano, First Vice President

Matthew Benoit, Vice President

Michael Hawes, Vice President

Sara Lundy, Vice President

Damen Norton, Vice President

Miria Gray, Assistant Vice President

Carleen Lee, Assistant Vice President

Kristen Scott, Assistant Vice President

Daniela Ness, Assistant Secretary

Samantha Powden, Assistant Secretary

Kyle Campbell, Assistant Secretary

Luann Vinson, Assistant Secretary

Rebecca Wesolowski, Assistant Vice President

Leadership Team

Anthony A. Joyce, III – President and Chief Executive Officer

Katherine Allingham – Senior Vice President, Chief Risk and Compliance Officer

Richard Balestracci – Senior Vice President, Commercial Lending Department Manager

Lori Dufficy – Executive Vice President, Chief Experience and Engagement Officer

Alex Masse – Executive Vice President, Chief of Operations & Innovation

Michael Sheahan – Executive Vice President, Chief Lending Officer

Jessica Todd – Executive Vice President, Chief Financial Officer

John Uyeki – Senior Vice President, Director of Financial Services

Larry Walker – Senior Vice President, Director of Technology

Anne Wilkinson – Senior Vice President, Chief Human Resources Officer

Kristin Zummo – Senior Vice President, Director of Strategy and Organizational Development

FIRST VICE PRESIDENTS

Kelly L. Allard – First Vice President, Loan Servicing and Lending Compliance Manager

Kathryn Alves – First Vice President, Credit Department Manager

Marie Carmenati – First Vice President, Retail Lending Underwriter Manager

Barb Curto – First Vice President, Marketing Manager

Tamela D. Higgins – First Vice President, Human Resources Manager

Alexis Kahn – First Vice President, Cash Management Sales Manager

Jean McGran – First Vice President, Member Experience Market Manager

Matthew Morrell – First Vice President, Retail Lending Sales Manager

William Mundell – First Vice President, Digital Banking Channel Manager

Mario Siciliano – First Vice President, Information Technology Manager

VICE PRESIDENTS

Matt Benoit – Vice President, Project Management Manager

Melissa Bierowka – Vice President, Commercial Loan Officer

Melinda M. Burridge – Vice President, Regional Sales and Service Manager

Christina M. Caplet – Vice President, Operations and Security Manager

Harry Colonis – Vice President, Business Development Officer

Al Dabiri – Vice President, Financial Advisor

Jennifer L. DeLucia – Vice President, Controller

Sarah A. Dion – Vice President, Internal Audit Manager

Jennifer Eastbourne – Vice President, Financial Services Program Coordinator

James M. Elliott, CFP – Vice President, Financial Advisor

Robert R. Fradette, CFP – Vice President, Financial Advisor

Beth Glynn – Vice President, Retail Loan Originator

Michael Hawes – Vice President, Commercial Loan Officer

Megan Kane – Vice President, Finance Manager

Sara Lundy – Vice President, Risk and Compliance Manager

Dawn M. McGinnis – Vice President, Loan Compliance and Acquisition Administrator

James J. McGuinness – Vice President, Commercial Loan Officer

Nancy Murphy – Vice President, Data Architect

Damen Norton – Vice President, Lending Compliance and Encompass Administrator

Paulette A. Retsinas, CFP – Vice President, Financial Advisor

Dawn Sandvoss – Vice President, Commercial Loan Officer

Patricia Startz – Vice President, Commercial Loan Officer

Marielle Winkelman – Vice President, Regional Sales and Service Manager

ASSISTANT VICE PRESIDENTS

Ishmael D. Bryan – Assistant Vice President, Collection Manager

Dana S. Chapel – Assistant Vice President, Customer Solutions Manager

Mandy-Lyn Crispim – Assistant Vice President, Cash Management Officer

Craig Cuffie – Assistant Vice President, Retail Lending Underwriter II

Lisa M. Fields – Assistant Vice President, Facilities Manager

Elvira Fiore-Labrecque – Assistant Vice President, Customer Care Center Manager

Miria Gray – Assistant Vice President, Community Education Officer

Maria Grenier – Assistant Vice President, Deposit Operations Manager

Penni Harlow – Assistant Vice President, Customer Solutions Manager

June Holaday – Assistant Vice President, Assistant to the President

Yana Kozleva – Assistant Vice President, Senior Auditor

Carleen Lee – Assistant Vice President, Customer Solutions Manager

Jason Levine – Assistant Vice President, System Administrator II

Rebecca Magner – Assistant Vice President, Learning & Development Manager

Kelly Meakem – Assistant Vice President, Digital Banking Operations Manager

Stephanie Mondro – Assistant Vice President, Associate Financial Advisor

Regan Nichols – Assistant Vice President, Customer Solutions Manager

Elizabeth Owen – Assistant Vice President, Lead Senior Credit Analyst & Sageworks Administrator

Kristen Scott – Assistant Vice President, Customer Solutions Manager

Karen S. Stearns – Assistant Vice President, Retail Branch Lending Specialist

Donna L. Thompson – Assistant Vice President, BSA Manager

Richard J. Turner – Assistant Vice President, Retail Loan Originator

Rebecca Wesolowski – Assistant Vice President, Loan Delivery and Quality Control Analyst

Jennifer Willingham – Assistant Vice President, Cash Management Officer

ASSISTANT TREASURERS

Samantha Bazydlo – Assistant Treasurer, Customer Solutions Manager

Giusy Beaman – Assistant Treasurer, Branch Operations Manager

Edwin Cotto-Morales – Assistant Treasurer, Customer Solutions Manager

Nicole Goodrow – Assistant Treasurer, Customer Solutions Manager

Ana Healy – Assistant Treasurer, Customer Experience Skills Coach

Tori Heim – Assistant Treasurer, Customer Solutions Manager

Rebecca Jacoinski – Assistant Treasurer, Benefits and Wellness Specialist

Michele Magowan – Assistant Treasurer, Retail Lending Sales Specialist

Kyle Main – Assistant Treasurer, Customer Solutions Manager

Deborah O’Brien – Assistant Treasurer, Customer Solutions Manager

Renee Simao – Assistant Treasurer, Talent Acquisition Specialist

Megan Susi – Assistant Treasurer, Customer Solutions Manager

ASSISTANT SECRETARIES

Krissa Beene – Assistant Secretary, Marketing Specialist

Christen Brewer – Assistant Secretary, Digital Innovation and Design Specialist

Kyle Campbell – Assistant Secretary, IT Support Specialist II

Jamie Goulas – Assistant Secretary, Retail Loan Originator

Heather Gumlaw – Assistant Secretary, Loan Servicing Assistant Manager

Linda M. Kosta – Assistant Secretary, Commercial Lending Administrator

Lisa Lamphere – Assistant Secretary, Commercial Lending Administrator

Christine Lataille-Santiago – Assistant Secretary, Human Resources Specialist

Daniela Ness – Assistant Secretary, Retail Lending Sales Specialist

Samantha Powden – Assistant Secretary, Learning and Development Specialist

Timothy Rich – Assistant Secretary, Financial Analyst

Lauren Vincent – Assistant Secretary, Small Business Loan Officer

Luann Vinson – Assistant Secretary, Retail Loan Originator

Anthony A. Joyce, III – President and Chief Executive Officer, Chelsea Groton Bank

D. Ben Benoit – President, PCW Management Center, LLC

Rodney A. Butler – Chairman, Mashantucket Pequot Tribal Nation

Betsy Conway – Legal Consultant, Mashantucket Pequot Tribal Nation

Mary Ellen Jukoski, Ed.D. – President, Three Rivers Community College

Kimberly Cardinal Piscatelli – Owner and Dealer Manager, Cardinal Honda

B. Michael Rauh, Jr. – Retired President and CEO, Chelsea Groton Bank

Thomas R. Switz – President, Switz Insurance and Real Estate

Seymour Adelman

Dr. Michael Alfultis*

Louis E. Allen, Jr.

Alexis Ann

Carl Banks*

Edward Bartelli

D. Ben Benoit

Wilfred J. Blanchette Jr.

Mark E. Block

Ellen C. Brown

Allyn L. Brown III

Wendy Bury

Rodney Butler

Leo E. Butler, Jr.

Pietro Camardella

Dennis J. Cambria D.D.S.

Stanley A. Cardinal*

Dr. Steven B. Carlow

Cynthia J. Casey

Stephen Coan

John A. Collins, III

Fred A. Conti

Elizabeth Conway

Valerie Cordock

Lori Danis

Samantha Descombes-Roseme

Abby I. Dolliver

Irene Donovan*

Michael E. Driscoll

Maryam Elahi

David P. Erskine

Tracy Espy

Ralph G. Fargo*

Peter S. Gianacoplos

Denison N. Gibbs*

Scott Gladstone

Robert H. Glass Jr.

Jeffrey R. Godley

Michael A. Goldblatt

Mark Grader

Ulysses B. Hammond

Donna Handley

Theodore A. Harris

Leah A. Hartman

Shiela Hayes

Thomas M. Hinsch

Cathleen J. Holland

Peter Hoops

Richard M. Hoyt Jr.

John J. James

Eric M. Janney

Christopher R. Jewell

Margarett L. Jones

Dr. Mary Ellen Jukoski

Nicholas F. Kepple

Pamela A. Kinder

Jon T. Kodama

Robert V. Krusewski*

Theodore M. Ladwig

Edwin Lorah

Jennifer J. Lowney, DMD

Paul V. Mathieu

Jeffrey A. McNamara

Daniel Meiser

Wilhelm W. Meya

Theodore S. Montgomery*

Dr. Naomi Nomizu

Mark R. Oefinger

Andrew C. Pappas

Patricia A. Pastor

Kimberly Cardinal Piscatelli

B. Michael Rauh

Felix Reyes

Caleb Roseme

Lottie B. Scott

Meagan E. Seacor

Dina Sears-Graves

Jonathan Shockley

John M. Smith*

William A. Stanley

Kathleen Stauffer

Kathleen A. Steamer*

Thomas R. Switz

Robert W. Tabor

Laurelle Texidor

William F. Turner

Robert A. Valenti

Edward J. Waitte

David A. Whitehead

Adam Young

Catherine Young

*Corporator Emeritus