By Patty Dupre, Operations and Security Risk Analyst, and Alexis Kahn, Cash Management Sales Manager at Chelsea Groton Bank

At Chelsea Groton Bank, our Cash Management and Security teams review countless checks and electronic transactions each day. Based on our experience reviewing, detecting, and preventing fraudulent checks from passing through, here are some tips for examining checks for fraud to help prevent businesses from falling victim to future scams.

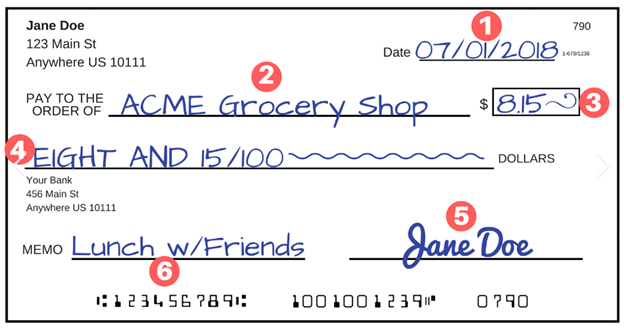

To start, let’s review the fundamental parts of a check (image with corresponding numbers is below). All parts, except #6, MUST be filled out properly, to be considered a valid check.

- 1- Date: Make sure it isn’t future-dated, or stale-dated; most checks are stale after six months unless otherwise stated on the check

- 2- Payee name: who the check is intended for

- 3- Numeric dollar value: how much the check is worth in numbers

- 4- Legal line: numeric value of the check written out in words

- 5- Maker’s signature: signature of the person/business that authorized the check

- 6- Memo: not always filled out, which is ok; states why the check was given/what is being paid for

***Bonus- Maker information in top left. It should include the name of the person or business issuing or authorizing the check and usually includes their address and sometimes a phone number. Sometimes a logo/name of a bank is included on the check but not always. If there isn’t a logo or bank name, it doesn’t necessarily mean it is invalid. The logo or name can be under the legal line or on the very top-middle of the check (in this example, between Jane Doe and the date area).

The set of numbers at the bottom of the check is called the MICR line (magnetic ink character recognition). This contains the routing number (123456789), which identifies a US financial institution and is 9 digits in length; the account number (1001001239), which identifies the customer account the bank will debit when the check is deposited in a receiving bank; and the check number (0790). (Check numbers are USUALLY on the top right but can be a little lower down or towards the middle of the check, too).

Now that we have reviewed the main features of a check, here are some ways to help identify potential fraudulent elements when you examine checks:

- Is the check filled out in its entirety? If not, return to the maker to complete or have it reissued.

- Is the size, style, and color of the writing/font consistent? If you are familiar with the check, does the stock (what the actual design of the paper check looks like) match what it has previously?

- Are there glaring misspellings or random/inconsistent capitalizations in words?

- Are there random things crossed out and/or written over? Does it look like any of the areas appear worn or are there extra breaks in lines indicating information could have been different and/or altered?

- Is the date valid, meaning is it current and not stale? If it is stale, then you need to have it reissued by the maker. If it is future dated, you can hold onto it until the check is valid or ask the maker for a check with the correct date.

- Does the check number in the MICR match the check number on the top right? Please note, if there is a 0 in the MICR but not the top right, that is OK.

- Do the numeric and legal line amounts match? If not, either have it reissued, or it can be negotiated by what it says on the legal line.

- Does the bank logo (if applicable) look blurry, fuzzy, stretched or just otherwise ‘off’?

- Is this a double-endorsed check, meaning a check made payable to one person, who then has a secondary person not listed on the check to negotiate? (For example, if it is payable to Mickey Mouse, did Mickey sign it over to [pay to the order of] Donald Duck so Donald can negotiate the check?)

- Does the memo line say “approved payment” or “payment approved”? If so, proceed with caution; these phrases are used to make a check appear more legitimate. Oftentimes, it signifies the check is likely fraudulent.

- Google the routing number to see if it matches the routing number of the bank from the check.

- Is the check for more than what it was supposed to be? Are you being asked to send the difference back?

- Are there security features on the check? Most checks will have a list on the back of the check if there are multiple features to look for. Sometimes, they just have a holographic image or a heat sensitive feature, where when you touch it, it goes from red/pink to white. Does the heat feature work (if applicable)? Is the holograph shiny and does it appear different at different angles, or is the image flat? If there is a list of security features on the back of the check, do they all present as they should?

Please note that anyone can order check stock from an office supply store, so the check paper itself may be legitimate, but that does not make a check legitimate.

If you are examining a bank or personal check, and find any of the above to be true, do not accept the payment. If you’re concerned that there has been a fraudulent attempt, you can report this incident to the Federal Trade Commission. They aggregate reports from various sources and use all “like” scenarios to investigate and prosecute. If you have incurred a financial loss as a result of a scam, please notify your bank as well as file a police report with your local police jurisdiction.

Chelsea Groton Bank has also compiled a breadth of information for businesses on how to help mitigate fraud, including tools and resources on protecting your financial accounts. If you have questions on the tools Chelsea Groton offers businesses to help safeguard accounts, please reach out to a member of the Bank’s Cash Management team at growthatbusiness@chelseagroton.com.